I’m working on a Accounting exercise and need support.

The internal rate of return (IRR) refers to the compound annual rate of return that a project generates based on its up-front cost and subsequent cash flows. Consider the case of Blue Llama Mining Company:

Blue Llama Mining Company is evaluating a proposed capital budgeting project (project Sigma) that will require an initial investment of $750,000.

Blue Llama Mining Company has been basing capital budgeting decisions on a project’s NPV; however, its new CFO wants to start using the IRR method for capital budgeting decisions. The CFO says that the IRR is a better method because returns in percentage form are easier to understand and compare to required returns. Blue Llama Mining Company’s WACC is 10%, and project Sigma has the same risk as the firm’s average project.

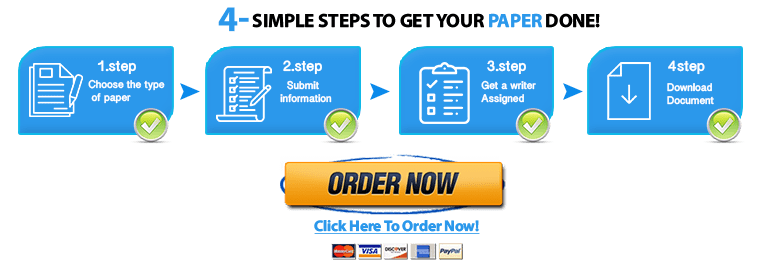

"Looking for a Similar Assignment? Order now and Get 10% Discount! Use Code "Newclient"